What are short-term investments on a balance sheet?

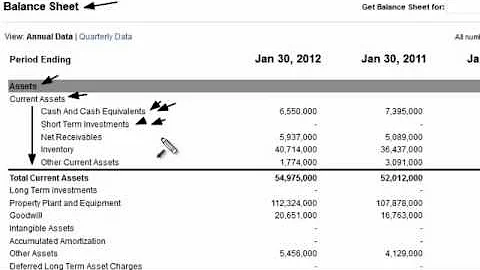

Recorded in a separate account, and listed in the current assets section of the corporate balance sheet, short-term investments in this context are investments that a company has made that are expected to be converted into cash within one year.

Short-term investments are disclosed as part of a company's current assets on its balance sheet. This is done in a separate account and the accounting of these investments is treated on the assumption that they will mature within one year.

Investment Options: Short-term investments encompass a variety of options, such as Savings account, Fixed deposits, Recurring deposits, National Savings Certificate, Liquid Funds, Investments in NCD's/ Corporate or Company Deposits, Treasury Securities, Post-Office Time Deposits.

Is a short-term investment a current asset? Yes, short-term investments are considered current assets for accounting purposes.

Short-term debt is defined as debt obligations that are due to be paid either within the next 12-month period or the current fiscal year of a business. Short-term debts are also referred to as current liabilities. They can be seen in the liabilities portion of a company's balance sheet.

If the investment is intended to be temporary, it is categorized as a current asset. If it intended to be long-term, it is a noncurrent asset.

The main sources of short-term financing are (1) trade credit, (2) commercial bank loans, (3) commercial paper, a specific type of promissory note, and (4) secured loans.

Short-term investments are those that can be readily converted into cash. This classification includes any investment instruments that will mature within one year or which are expected to be liquidated within one year. Examples of these instruments are money market funds and marketable securities.

Subsequent to initial acquisition, short-term investments are to be reported at their fair value. The fluctuation in value is reported in the income statement. This approach is often called “mark-to-market” or fair value accounting.

Short-term assets or securities in investments refer to assets that are held for less than one year. In accounting, the term "current" refers to a short-term asset, which means, expected to be converted into cash in less than one year, or a liability, coming due in less than one year.

Are current assets and short-term investments the same?

Current assets include cash and cash equivalents, inventory, accounts receivable, prepaid expenses (your annual insurance policy, for example) and short-term investments.

Current assets are assets that the company plans to use up or sell within one year from the reporting date. This category includes cash, accounts receivable, and short-term investments.

Short-term liabilities cover any debt that must be paid within the coming year. This includes interest payments on loans (but not necessarily the principal of the loan), monthly utilities, short-term accounts payable, and so on. Long-term liabilities cover any debts with a lifespan longer than one year.

Investments appear on a balance sheet in several ways: as common or preferred shares, mutual funds and notes payable. Sometimes they are made to put excess cash to work for short periods. Other times they are used more strategically over longer periods.

Some examples of short-term liabilities include payroll expenses and accounts payable, which include money owed to vendors, monthly utilities, and similar expenses. Other examples include: Wages Payable: The total amount of accrued income employees have earned but not yet received.

Short term debt is any debt that is payable within one year. Short-term debt shows up in the current liability section of the balance sheet. Long-term debt is debt that are notes payable in a period of time greater than one year. Long-term debt shows up in the long-term liabilities section of the balance sheet.

Short-term assets are also known as current assets and refer to those company belongings that have a low shelf-life. These include cash, securities, accounts receivable and expenses like rent. It helps describe how liquid the company is and how it plans to fund its ongoing operations on a day-to-day basis.

Fixed assets, which are sometimes referred to as plant assets, are defined as long-term investments and, unlike current (short-term) assets, cannot not be acquired for resale or otherwise turned into cash within an accounting period.

Short-term investments and long-term investments are distinguished by how you use them. A stock in the hands of a day trader who sells it within a few hours is undoubtedly a short-term investment. When held in a 401(k) for several years or longer, however, that same stock would be considered a long-term investment.

Some of the desired traits in short-term investments are safety, liquidity, and returns, and money market accounts have these characteristics. Money market accounts are ideal places for corporations and investors to park their cash for a short time while they wait for an opportunity to deploy it.

Which source of funds classified under short term?

Short-term sources: Funds which are required for a period not exceeding one year are called short-term sources. Trade credit, loans from commercial banks and commercial papers are the examples of the sources that provide funds for short duration.

Short-term debt, also called current liabilities, is a firm's financial obligations that are expected to be paid off within a year. Common types of short-term debt include short-term bank loans, accounts payable, wages, lease payments, and income taxes payable.

Cash and Short Term Investments is calculated by taking all the cash and short term investments of the company and dividing that number by the total shares outstanding.

A long-term investment is an account on the asset side of a company's balance sheet that represents the company's investments, including stocks, bonds, real estate, and cash. Long-term investments are assets that a company intends to hold for more than a year.

The investment is first recorded at its historical cost, then adjusted based on the percent ownership the investor has in net income, loss, and any dividend payments. Net income increases the value on the investor's income statement, while both loss and dividend payouts decrease it.

References

- https://www.investopedia.com/terms/s/shortterm.asp

- https://www.personalfinancelab.com/finance-knowledge/personal-finance/short-term-financing/

- https://www.wordreference.com/synonyms/rich

- https://www.thestreet.com/investing/short-term-investing-vs-long-term-investing

- https://www.financestrategists.com/wealth-management/financial-statements/liability/

- https://www.investopedia.com/terms/e/equitymethod.asp

- https://www.homecredit.co.in/en/paise-ki-paathshala/detail/long-term-vs-short-term-nvestments-pros-and-cons

- https://blog.hubspot.com/sales/silent-partner

- https://www.investopedia.com/terms/l/liability.asp

- https://www.bajajfinserv.in/investments/best-short-term-investment-schemes-to-make-money

- https://www.coregroupus.com/the-planner-blog/what-is-the-difference-between-short-term-and-long-term-debt

- https://www.toppr.com/guides/business-studies/sources-of-business-finance/classification-of-sources-of-funds/

- https://corporatefinanceinstitute.com/resources/wealth-management/investor/

- https://groww.in/p/short-term-stocks

- https://www.investopedia.com/terms/s/shorttermdebt.asp

- https://www.thesaurus.com/browse/profitable

- https://www.bdc.ca/en/articles-tools/entrepreneur-toolkit/templates-business-guides/glossary/angel-investor

- https://www.merriam-webster.com/thesaurus/wealthy

- https://homework.study.com/explanation/which-of-the-following-is-not-an-important-characteristic-of-short-term-marketable-securities-a-maturity-risk-b-marketability-c-taxability-d-default-risk-e-all-of-the-above-are-important.html

- https://corporatefinanceinstitute.com/resources/wealth-management/long-term-investments/

- https://www.investopedia.com/terms/i/investmentadvisor.asp

- https://dictionary.cambridge.org/us/dictionary/english/personal-investor

- https://www.investopedia.com/terms/s/shareholder.asp

- https://corporatefinanceinstitute.com/resources/career-map/sell-side/capital-markets/short-term-vs-long-term-investors/

- https://www.investopedia.com/terms/l/longterminvestments.asp

- https://www.cnbc.com/select/best-short-term-investments/

- https://www.toptal.com/finance/equity-research-analysts/warren-buffett-investment-strategy

- https://www.financialmentor.com/investment-advice/investment-strategy-alternative/types-of-investors/18150

- https://www.bankrate.com/investing/best-short-term-investments/

- https://www.oxfordlearnersdictionaries.com/definition/english/profitable

- https://www.oreilly.com/library/view/invest-like-a/9780132213080/ch03.html

- https://study.com/learn/lesson/short-term-investments-treasuries-examples.html

- https://fastercapital.com/startup-topic/risks-associated-with-short-term.html

- https://courses.lumenlearning.com/wm-financialaccounting/chapter/short-term-investments/

- https://homework.study.com/explanation/what-are-the-primary-differences-between-investor-owned-and-not-for-profit-corporations.html

- https://www.stockopedia.com/ratios/cash-short-term-investments-latest-5106/

- https://corporatefinanceinstitute.com/resources/accounting/short-term-debt/

- https://www.rivier.edu/academics/blog-posts/whats-the-difference-venture-capitalist-vs-angel-investor/

- https://www.investopedia.com/terms/i/investor.asp

- https://www.investopedia.com/ask/answers/what-are-short-term-investment-options/

- https://www.principlesofaccounting.com/chapter-6/trading-securities/

- https://www.investopedia.com/ask/answers/040915/what-difference-between-fixed-assets-and-current-assets.asp

- https://www.investopedia.com/invest-for-short-term-and-long-term-goals-8347417

- https://www.britannica.com/money/business-finance/Short-term-financing

- https://eqvista.com/types-of-company-funding/different-type-of-investors/

- https://bizversity.com/definition/what-are-short-term-assets-definition-or-meaning/

- https://www.corporateguardian.com.au/short-term-finance-pros-and-cons/

- https://www.bankrate.com/investing/long-and-short-stock-positions/

- https://www.wallstreetmojo.com/short-term-financing/

- https://edufund.in/blog/what-type-of-an-investor-are-you

- https://www.bdc.ca/en/articles-tools/entrepreneur-toolkit/templates-business-guides/glossary/investments

- https://www.financestrategists.com/accounting/financial-statements/balance-sheet/current-assets/is-short-term-investment-a-current-asset/

- https://www.investopedia.com/terms/p/passiveinvesting.asp

- https://en.wikipedia.org/wiki/Short-term_trading

- https://www.thesaurus.com/browse/grow-rich

- https://www.thesaurus.com/browse/get-rich

- https://www.vocabulary.com/dictionary/profitable

- https://corporatefinanceinstitute.com/resources/career-map/sell-side/capital-markets/short-term-investments/

- https://www.mass.gov/info-details/what-is-a-pooled-fund

- https://mailchimp.com/resources/what-is-a-silent-partner/

- https://brainly.com/question/11701924

- https://www.xero.com/us/glossary/current-vs-fixed-assets/

- https://www.bookstime.com/articles/plant-assets

- https://www.linkedin.com/pulse/short-term-loans-versus-long-term-comprehensive-guide-protiumindia

- https://www.accountingtools.com/articles/short-term-investments